How do out-of-pocket costs work?

Copays, deductibles, and coinsurance let you know when and how much you may need to pay for your health care. We’re here to help you understand the meaning of these important health care terms.

Let’s take an in-depth look at what these terms mean, how they work together, and how they are different.

Copays

What is a copay?

A copay (or copayment) is a flat fee that you pay on the spot each time you go to your doctor or fill a prescription. For example, if you hurt your back and go see your doctor, or you need a refill of your child’s asthma medicine, the amount you pay for that visit or medicine is your copay. Your copay amount is printed right on your health plan ID card. Copays cover your portion of the cost of a doctor’s visit or medication.

Do I always have a copay?

Not necessarily. Not all plans use copays to share in the cost of covered expenses. Or, some plans may use both copays and a deductible/coinsurance, depending on the type of covered service. Also, some services may be covered at no out-of-pocket cost to you, such as annual checkups and certain other preventive care services.

Deductibles

What is a deductible?

A deductible is the amount you pay each year for most eligible medical services or medications before your health plan begins to share in the cost of covered services. For example, if you have a $2,000 yearly deductible, you’ll need to pay the first $2,000 of your total eligible medical costs before your plan helps to pay.

Deductibles for family coverage and individual coverage are different. Even if your plan includes out-of-network benefits, your deductible amount will typically be much lower if you use in-network doctors and hospitals.

Coinsurance

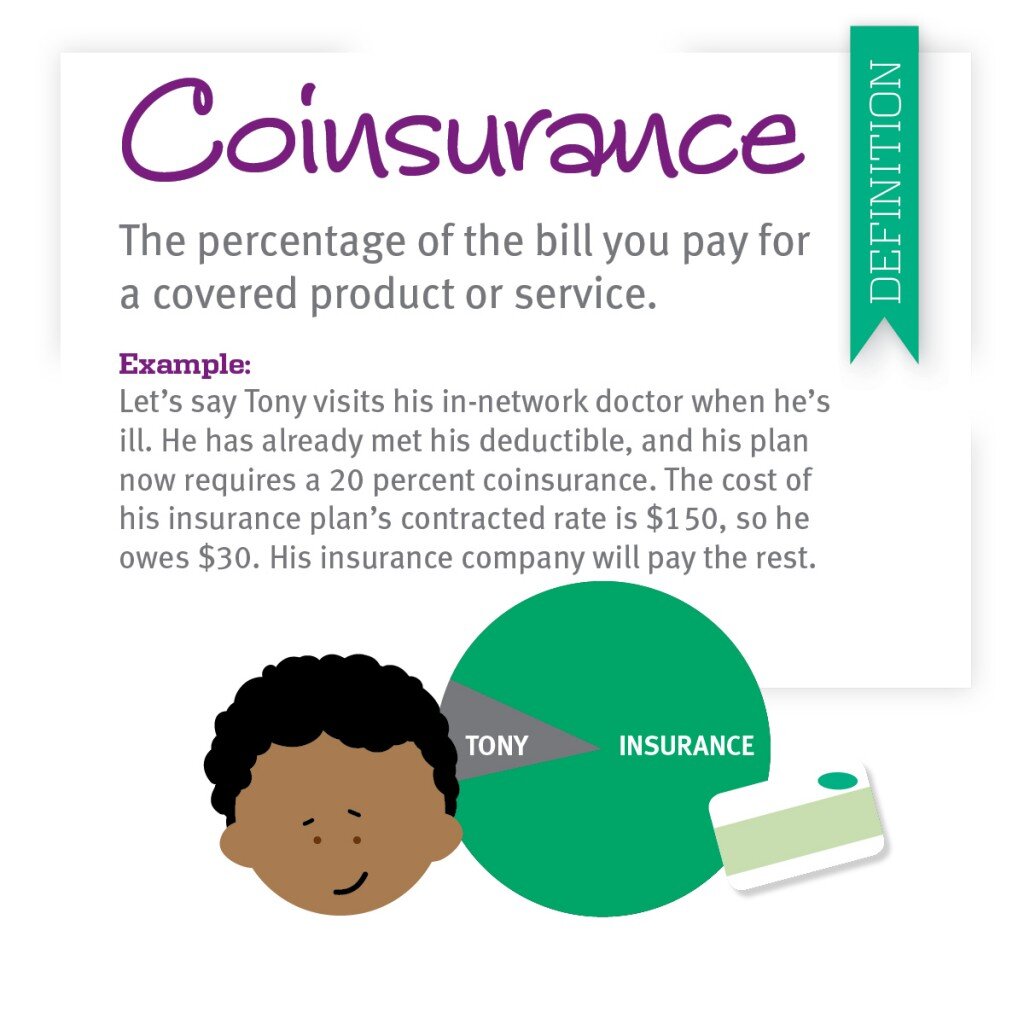

What is coinsurance?

Coinsurance is a portion of the medical cost you pay after your deductible has been met. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent.

What Are Out-of-Pocket Maximums?

Out-of-Pocket expenses are health care costs that are not covered by insurance, for example, if your spending has not yet reached your plan deductible. The out-of-pocket maximum is the maximum amount of out-of-pocket expenses you will have to pay in one year.

Once you reach your out-of-pocket maximum, your health insurance plan covers 100% of all covered services for the rest of the year. Any money you spend on deductibles, copays, and coinsurance counts toward your out-of-pocket maximum. However, premiums don’t count, and neither does anything you spend on services that your plan doesn’t cover.

Like deductibles, you might have two out-of-pocket limits—an individual one and a family one. Under the Affordable Care Act, the highest allowable out-of-pocket maximum is set at $8,550 for individual coverage and $17,100 for family coverage.

What is the difference?

Deductible VS Copay

Depending on your health plan, you may have a deductible and copays.

A deductible is the amount you pay for most eligible medical services or medications before your health plan begins to share in the cost of covered services. If your plan includes copays, you pay the copay flat fee at the time of service (at the pharmacy or doctor’s office, for example). Depending on how your plan works, what you pay in copays may count toward meeting your deductible.

Copays VS Coinsurance

A copay is a set rate you pay for prescriptions, doctor visits, and other types of care.

Coinsurance is the percentage of costs you pay after you’ve met your deductible. A deductible is the set amount you pay for medical services and prescriptions before your coinsurance kicks in.