Who We Are

“Tohi” is a Cherokee word for wellness, the ideal state of being, peace. “You are in good health when your body and mind are at peace.” Wellness in Cherokee is described as the “harmony between mind, body, and spirit”. As a member of Cherokee Nation, our founder is proud of her lineage and wanted to incorporate some respect to it in the company name.

Our Mission

“To help find affordable coverage for those with urgent medical needs & any minority & low income individuals.”

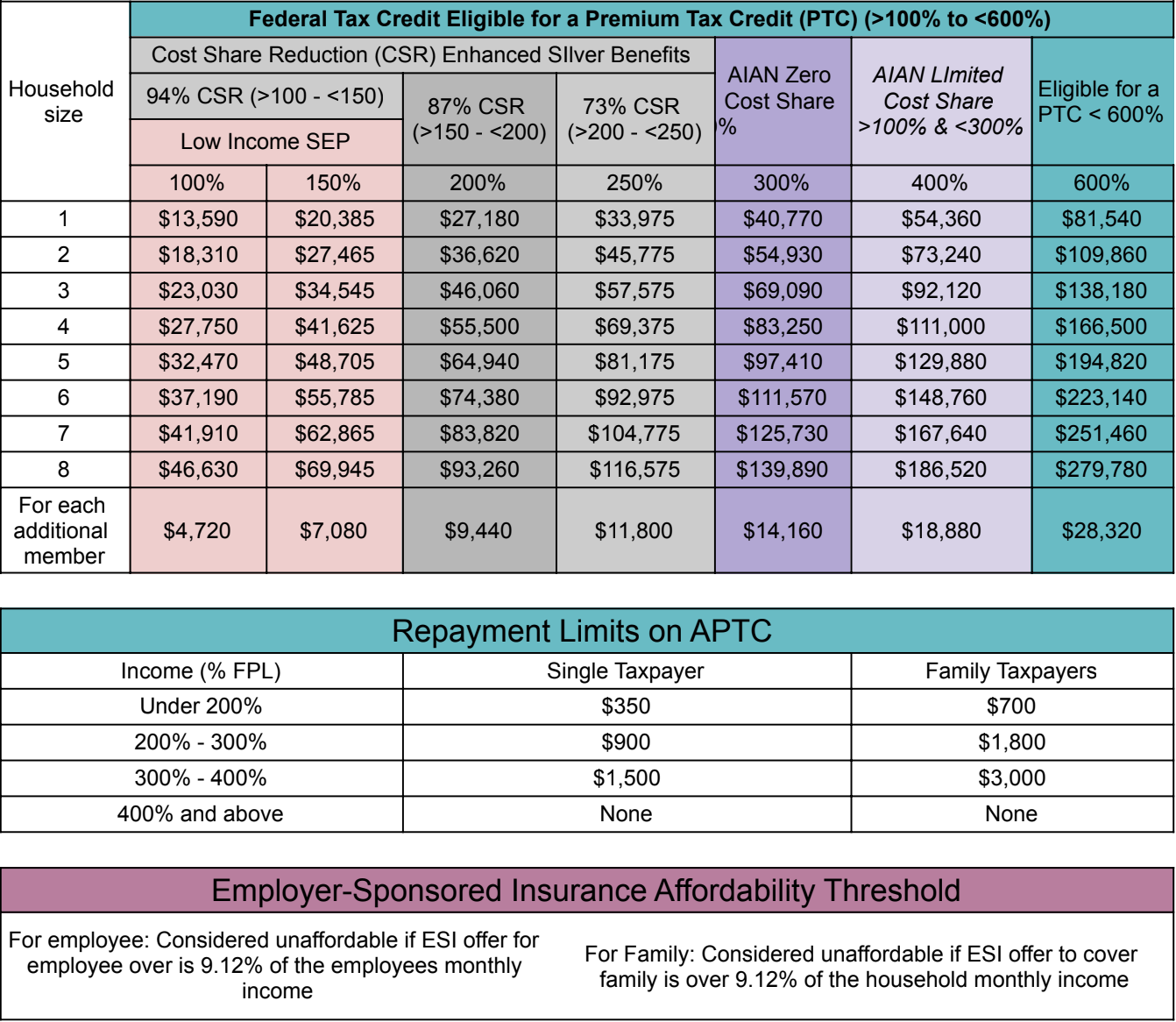

The Affordable Care Act ensures all person’s legally residing in the US have access to healthcare that will not deny care due to medical history. The program also provides assistance to those who are not qualified for Medicare or Medicaid, do not have a plan offered from their employer, and have income under 600% of the poverty level. Individuals and families who are under 150% of the poverty level qualify for enrolling in plans year around, as opposed to the standard requirement to enroll during Annual open enrollment (Nov 1 - Jan 15).

-

See the chart in our financial assistance tab to see if you qualify for financial assistance!

Insurance for Native Americans

Many tribes have

healthcare facilities available on tribal land and reservations,

however, only 1/3 of the American Indian or Alaska Native

(AI/AN) population lives on reservations, with another 26%

living in counties surrounding tribal areas. Therefore there is

much need for affordable healthcare access outside of the

nations. Not to mention, sometimes access to care at Tribal

facilities is often crowded or lacking specialties that may be

needed by native individuals.

The ACA solves this issue for Native Americans, unfortunately so

many do not realize what great benefits they have available to

them! Oklahoma and Arkansas, for example, have real PPO coverage

that, depending on income, may offer totally free premiums with

$0 deductibles and out of pocket Max.

Native Americans in Poverty

Our goal is to reach as many Natives who may need assistance

described above. Sadly, Native Americans have the highest

poverty rate among all minority groups in the U.S. Although we

wish to help all minorities and low income individuals and

families, the native community is one very close to our hearts.

Why choose us

We understand that one plan or one company does not fit all. We

consider YOUR personal needs and budget before making a

recommendation. You can expect our sincere and honest opinions

when evaluating your needs. We are dedicated to changing your

opinion of this industry. It’s not about selling, but helping

solve problems.

When we say "I want to be your Agent", we mean for life. Long

after you enroll, to assist when you need us most.

Types of Health Plans

What is an HMO?

An HMO, or Health Maintenance Organization, is a type of health plan that offers a local network of doctors and hospitals for you to choose from. It usually has lower monthly premiums than a PPO or an EPO health plan. An HMO may be right for you if you’re comfortable choosing a primary care provider (PCP) to coordinate your health care and are willing to pay a higher deductible to get a lower monthly health insurance premium.

What is a PPO?

A Preferred Provider Organization (PPO), is a type of health plan that offers a larger network so you have more doctors and hospitals to choose from. Your out-of-pocket costs are usually higher with a PPO than with an HMO or EPO plan. If you're willing to pay a higher monthly premium to get more choice and flexibility in choosing your physician and health care options, you may want to choose a PPO health plan.

What is an EPO?

An Exclusive Provider Organization (EPO), is a type of health plan that offers a local network of doctors and hospitals for you to choose from. An EPO is usually more pocket-friendly than a PPO plan. However, if you choose to get care outside of your plan’s network, it usually will not be covered (except in an emergency). If you’re looking for lower monthly premiums and are willing to pay a higher deductible when you need health care, you may want to consider an EPO plan.

What is an POS?

A Point of Service (POS), as with an HMO, requires that you get a referral from your primary care physician (PCP) before seeing a specialist. But for slightly higher premiums than an HMO, this plan covers out-of-network doctors, though you’ll pay more than for in-network doctors. This is an important difference if you are managing a condition and one or more of your doctors are not in network.

What’s a High-Deductible Health Plan?

A high-deductible health plan (HDHP), is an inexpensive health insurance plan with low premiums but a very high deductible. Because they may come with significant out-of-pocket expenses, these plans are popular for young, healthy workers with low routine medical expenses who are worried about catastrophic health care events.

An HDHP can be an HMO, POS, PPO or EPO. People who are managing a health condition but can’t afford higher monthly premiums may find that an HDHP saves them money in the long run.

An additional benefit of high-deductible plans is the Health Savings Account (HSA), which is only available to workers with a HDHP. These savings accounts are tax-free, so long as the money is used for qualified medical expenses.

HDHP with HSA: Offset out-of-pocket costs with a health savings account.

A High Deductible Health Plan (HDHP) has low premiums but higher immediate out-of-pocket costs. Employers often pair HDHPs with a Health Savings Account (HSA) funded to cover some or all of your deductible. You may also deposit pre-tax dollars in your account to cover medical expenses, saving you about 30%. And remember, depending on your age, services such as mammograms, colonoscopies, annual well visits and vaccinations may be covered free of charge, even if you haven’t met your deductible.

Financial Assistance Chart